Insights and Strategies for Bookkeeping Money Advice Ontpeconomy

Bookkeeping serves as the backbone of financial management for both individuals and businesses. It fosters clarity and allows for informed decision-making. By leveraging essential tools and adopting strategic budgeting techniques, users can navigate their economic environments more effectively. Understanding the intricacies of maintaining accurate financial records is key. This exploration of bookkeeping insights reveals more than just numbers; it uncovers a pathway to financial independence and confidence in uncertain times.

Understanding the Basics of Bookkeeping

Bookkeeping serves as the backbone of financial management, providing a structured method for recording and analyzing financial transactions.

Understanding the basics of bookkeeping principles enhances financial literacy, empowering individuals to make informed decisions.

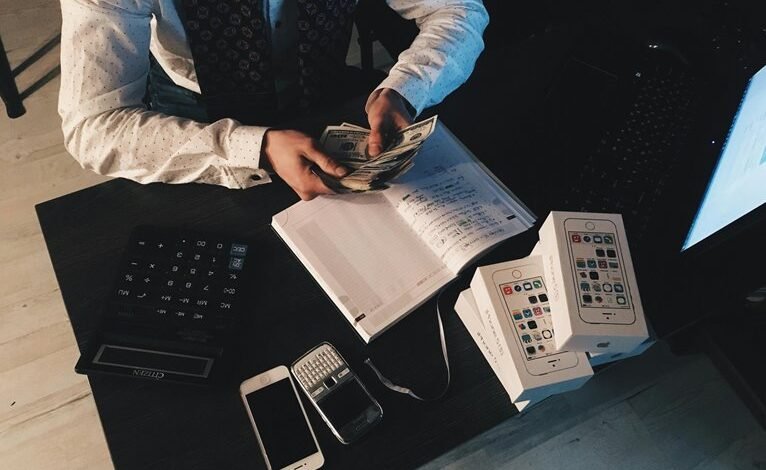

Essential Tools for Effective Financial Management

Effective financial management relies on a suite of essential tools that streamline processes and enhance decision-making.

Cloud accounting platforms offer real-time access to financial data, fostering transparency and collaboration.

Meanwhile, robust financial software automates routine tasks, reducing errors and freeing resources for strategic planning.

Together, these tools empower individuals and businesses to maintain control over their finances, supporting a journey towards financial independence.

Strategies for Budgeting and Expense Tracking

While many individuals and businesses recognize the importance of tracking their finances, developing effective strategies for budgeting and expense tracking can significantly enhance overall financial health.

Implementing diverse budgeting techniques allows for better categorization of expenses, facilitating informed decision-making. By establishing clear expense categories, individuals can identify spending patterns, prioritize needs, and ultimately achieve greater financial freedom while maintaining control over their economic landscape.

Tips for Maintaining Accurate Financial Records

To ensure financial accuracy, maintaining well-organized records is essential for both individuals and businesses alike.

Effective record keeping facilitates smooth financial audits and aids in identifying discrepancies early. Regularly updating records, utilizing digital tools, and categorizing expenses can enhance transparency.

Implementing these strategies empowers individuals and businesses to navigate their financial landscape confidently, ultimately promoting freedom and informed decision-making.

Conclusion

In conclusion, mastering bookkeeping is akin to navigating a complex maze; it requires careful planning and insight to reach the desired destination of financial stability. By employing effective strategies, utilizing essential tools, and maintaining meticulous records, individuals and businesses can enhance their financial literacy and confidence. As the economic landscape continues to evolve, these practices serve as a sturdy foundation, empowering users to make informed decisions and adapt to changing financial circumstances with agility and foresight.