50 Mastering Bookkeeping Fundamentals Relations Tips Fpmomhacks

Mastering bookkeeping fundamentals is crucial for effective financial management. Accurate record keeping lays the foundation for informed decision-making. Establishing a systematic bookkeeping system and selecting the right accounting software can streamline processes. Understanding cash versus accrual accounting is essential for clarity. As one explores these elements, the importance of continuous learning in finance becomes evident. What strategies can one implement to build a robust financial framework? The insights that follow may offer valuable guidance.

Understanding the Basics of Bookkeeping

Bookkeeping serves as the backbone of financial management, providing essential insights into an organization's economic health.

Understanding bookkeeping principles is crucial, as they govern the systematic recording of financial transactions.

Mastery of financial terminology aids in accurate communication of data, facilitating informed decisions.

Importance of Accurate Record Keeping

How can organizations ensure financial stability and growth?

Accurate record keeping is crucial for maintaining financial integrity and operational efficiency. By adhering to documentation standards and ensuring record accuracy, organizations can achieve compliance assurance and audit readiness.

This practice also provides a historical reference for data consistency, aids in risk mitigation, and fulfills legal requirements, ultimately supporting sustainable growth and informed decision-making.

Setting Up a Bookkeeping System

Establishing a robust bookkeeping system is essential for any organization aiming to maintain financial clarity and control. This involves choosing templates, defining workflows, and establishing checkpoints.

Integrating tools and setting reminders further enhances efficiency. Customizing reports and aligning roles ensures accountability, while creating manuals aids in standardization.

Monitoring progress and reviewing policies regularly enables adaptability, fostering a proactive and organized financial environment.

Choosing the Right Accounting Software

When selecting the right accounting software, organizations must consider various factors that align with their unique needs and goals.

Key elements include cloud-based solutions, user-friendly interfaces, and robust integration capabilities. Cost considerations, customer support options, and scalability features are essential, as are security measures and mobile accessibility.

Additionally, customization options, training resources, reporting functionalities, software reviews, and compliance features are critical for successful implementation.

Differentiating Between Cash and Accrual Accounting

Understanding the distinction between cash and accrual accounting is crucial for effective financial management.

Cash accounting emphasizes cash flow, recording revenue and expenses when cash changes hands. In contrast, accrual accounting focuses on revenue recognition and expense matching, enhancing financial reporting accuracy.

This choice impacts tax implications, operational efficiency, and strategic business decision making, fostering financial transparency and assessing economic impact while adhering to fundamental accounting principles.

Familiarizing Yourself With Financial Statements

A solid grasp of cash and accrual accounting sets the stage for a deeper comprehension of financial statements, which serve as vital tools for assessing a company's economic health.

Effective financial statement analysis involves interpreting balance sheets and understanding income statements, while mastering cash flow is crucial for strategic decision-making.

This knowledge empowers individuals to evaluate performance and forecast future financial scenarios with confidence.

The Role of a Chart of Accounts

The chart of accounts serves as the backbone of an organization's financial infrastructure, providing a systematic categorization of all financial transactions.

This essential tool facilitates account hierarchy and transaction classification, enhancing financial organization.

Tracking Income and Expenses Effectively

Effective tracking of income and expenses is vital for maintaining financial stability within an organization. By implementing systematic income categorization, businesses can gain insights into revenue streams.

Additionally, expense forecasting allows for proactive financial planning, enabling organizations to anticipate future costs. This dual approach empowers decision-makers to optimize resources, ultimately fostering an environment conducive to growth and financial freedom.

The Importance of Reconciliation

Reconciliation is a crucial process in bookkeeping that ensures the accuracy of financial records by comparing internal accounts with external statements.

Regular reconciliation provides numerous benefits, including error detection and improved financial oversight.

However, it also presents challenges that can complicate the process, requiring careful management to maintain financial integrity.

Benefits of Regular Reconciliation

Accuracy in financial records is paramount for any business, and regular reconciliation serves as a critical tool to achieve this goal.

The reconciliation benefits include enhanced financial accuracy, detection of discrepancies, and improved cash flow management.

Common Reconciliation Challenges

The process of reconciling financial records often presents a variety of challenges that can undermine a business's efforts for accuracy.

Common issues include reconciliation discrepancies, data entry errors, and timing differences. Effective bank statement comparison and transaction matching require robust audit trail analysis and policy enforcement.

Additionally, software integration issues and communication barriers hinder stakeholder coordination, complicating the reconciliation process.

Managing Receivables and Payables

Effective management of receivables and payables is crucial for maintaining a healthy cash flow within a business.

This involves meticulously tracking outstanding invoices, streamlining payment processes, and fostering positive vendor relationships.

Tracking Outstanding Invoices

While many businesses prioritize generating sales, the importance of diligently tracking outstanding invoices cannot be overstated.

Effective cash flow management hinges on timely invoice reminders, payment follow-ups, and clear customer communication. Implementing automated tracking systems helps address invoice disputes and overdue notices promptly.

Streamlining Payment Processes

Streamlining payment processes is essential for maintaining healthy cash flow and operational efficiency within a business.

Optimizing payment workflows enhances customer experience by automating invoicing processes and integrating payment gateways. By reducing transaction fees and improving the cash cycle, businesses can effectively manage subscription payments.

Offering multiple payment options and tracking payment disputes further facilitates streamlined expense approvals, ensuring timely receivables and payables management.

Managing Vendor Relationships

A strong vendor relationship can significantly impact a business's ability to manage receivables and payables efficiently.

By negotiating terms and setting clear expectations, companies can enhance collaboration.

Building trust and fostering communication are essential for resolving conflicts and managing disputes.

Regularly assessing performance and maintaining consistency ultimately strengthen partnerships, allowing for smoother transactions and improved financial health.

Implementing a Budgeting Strategy

How can one effectively implement a budgeting strategy that aligns with financial goals?

Utilizing budgeting tools enables individuals to categorize expenses and set limits. Forecasting accuracy enhances financial discipline, while evaluating needs helps prioritize spending.

Regularly tracking progress through monthly reviews allows for adjusting budgets as necessary, ensuring that expense categories remain aligned with overarching objectives and fostering a sense of financial freedom.

Utilizing Financial Ratios for Analysis

What insights can financial ratios provide for effective analysis?

Financial ratio analysis offers critical perspectives on a business's financial health through profitability ratios, liquidity ratios, efficiency ratios, and market ratios.

By employing trend analysis and benchmark comparisons, one can enhance ratio interpretation and gauge business valuation.

These metrics collectively empower stakeholders to make informed decisions, fostering greater financial freedom and strategic growth.

Best Practices for Invoicing

Establishing effective invoicing practices is crucial for maintaining healthy cash flow and ensuring timely payments. A clear invoice design enhances professionalism and reduces confusion.

Including concise payment terms allows clients to understand their obligations, promoting faster payments. Additionally, implementing follow-up reminders and offering multiple payment options can further streamline the process, ultimately fostering stronger client relationships and supporting financial independence for the business.

Understanding Payroll Accounting

When considering the complexities of payroll accounting, one must recognize its pivotal role in ensuring that employees are compensated accurately and on time.

Effective payroll management involves wage calculations, payroll deductions, and compliance with overtime regulations.

Utilizing payroll software streamlines payroll reporting, tax withholding, and payroll schedules, while addressing employee benefits and payroll taxes ensures adherence during compliance audits, fostering a transparent workplace.

Handling Taxes and Compliance

Although navigating the intricate landscape of taxes and compliance can be daunting, it remains an essential aspect of effective bookkeeping.

Employing tax preparation tips and compliance checklists enhances efficiency. Implementing tax deduction strategies and audit readiness techniques safeguards against potential issues.

Staying mindful of filing deadlines and organizing tax documentation fosters understanding of tax codes, while effective IRS communication strategies and quarterly tax planning ensure optimal tax liability management.

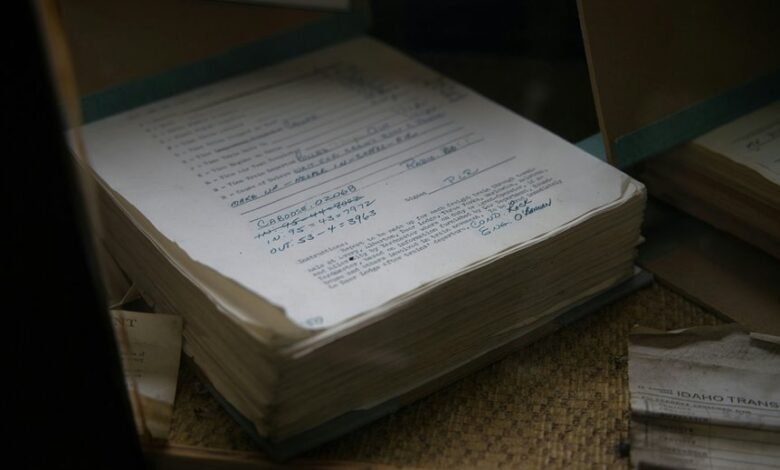

Organizing Financial Documents

Effective organization of financial documents is crucial for maintaining clarity and efficiency in bookkeeping practices.

Document categorization into specific folders streamlines access to necessary information, enhancing productivity.

Transitioning to digital storage not only saves physical space but also facilitates easy retrieval and sharing of documents.

Backing Up Your Financial Data

Backing up financial data is crucial for safeguarding against data loss and ensuring business continuity.

It is essential to choose appropriate backup methods and secure locations that align with the organization's needs. Regular backups not only protect sensitive information but also enhance overall financial management practices.

Importance of Regular Backups

Why is the regular backup of financial data considered a cornerstone of effective bookkeeping?

Implementing data redundancy strategies and adhering to backup frequency importance ensures data integrity.

Utilizing cloud storage options alongside local backup advantages enhances disaster recovery planning.

Employing backup automation tools and encryption methods protects sensitive information, while efficient backup restoration processes and multi-location backups further safeguard against data loss, fostering a secure financial environment.

Choosing Backup Methods

How can businesses ensure the safety and accessibility of their financial data?

Employing a combination of cloud storage, external drives, and physical copies provides robust data redundancy.

Automated backups with regular backup frequency enhance disaster recovery plans.

Utilizing backup encryption and conducting backup testing in secure locations fortifies data integrity, ensuring that critical financial information remains protected against potential threats and accessible when needed.

Securing Backup Locations

A secure backup location is essential for safeguarding financial data against loss and unauthorized access.

Utilizing cloud storage and external drives ensures data redundancy. Regular updates and automated backups maintain current information. Implementing encryption methods during secure transfers enhances protection.

Local backups paired with offsite storage optimize accessibility. Establishing a consistent backup frequency fortifies the integrity and security of financial records, empowering users with peace of mind.

Creating a Financial Calendar

Creating a financial calendar is an essential practice for effective bookkeeping, providing a structured approach to managing deadlines and financial obligations.

It facilitates financial reminders and ensures timely completion of annual budgeting tasks. By organizing key dates, such as tax deadlines and payment schedules, individuals and businesses can maintain clarity in their financial commitments, fostering a sense of freedom and control over their financial landscape.

Establishing Internal Controls

Maintaining a financial calendar sets the stage for the establishment of internal controls, which are vital for safeguarding an organization's assets and ensuring the integrity of its financial reporting.

Effective internal controls incorporate risk assessment, segregation of duties, and compliance monitoring, while fostering operational efficiency. Additionally, robust control policies enhance internal audits and serve as a crucial component of fraud prevention and financial oversight.

Monitoring Cash Flow

Monitoring cash flow is essential for maintaining the financial health of a business.

Effective management of cash inflows and tracking of cash outflows provide insights into liquidity and operational efficiency.

Additionally, employing profitability analysis techniques can enhance decision-making and strategic planning.

Cash Inflows Management

Effective cash inflows management is crucial for any business, as it directly influences financial stability and growth potential.

By implementing robust cash flow forecasting techniques, businesses can anticipate revenue streams and make informed decisions.

Furthermore, effective liquidity management ensures that sufficient cash is available to meet obligations, ultimately enhancing operational efficiency and providing the flexibility necessary for strategic investments and expansions.

Cash Outflows Tracking

A comprehensive approach to cash outflows tracking is essential for businesses aiming to maintain financial health and operational efficiency.

By categorizing expenses, analyzing transaction types, and adhering to payment schedules, companies can create budget forecasts and cash flow projections.

Monitoring spending patterns and outflow trends helps safeguard cash reserves, allowing for informed financial decisions and accurate expense reports that enhance overall cash flow management.

Profitability Analysis Techniques

Profitability analysis techniques serve as vital tools for businesses seeking to evaluate their financial performance and optimize cash flow.

These methods include profit margin analysis, cost structure evaluation, and break even assessment.

Trend analysis techniques and revenue forecasting methods provide insights into future performance, while competitive benchmarking strategies and market share assessment aid in strategic positioning.

Variance analysis techniques and pricing strategy evaluation enhance understanding of financial health indicators.

Managing Inventory and Cost of Goods Sold

Mastering the intricacies of inventory management and understanding the cost of goods sold (COGS) are essential components in the realm of bookkeeping.

Effective inventory valuation methods, such as FIFO and LIFO, play a crucial role in determining accurate COGS.

Additionally, implementing robust cost allocation strategies enables businesses to optimize their financial performance, ensuring clarity in tracking expenses and maintaining operational efficiency.

Understanding Depreciation and Amortization

While many businesses focus on revenue generation, understanding depreciation and amortization is equally vital for accurate financial reporting and asset management.

Depreciation methods, such as straight-line or declining balance, affect long-term asset valuation. Amortization schedules facilitate the expense categorization of intangible assets.

Both concepts carry significant tax implications, impacting overall financial health and ensuring transparency in reporting for stakeholders.

The Importance of Financial Forecasting

Financial forecasting plays a crucial role in effective bookkeeping by offering insights into future revenue and expense trends.

Accurate predictions can help businesses allocate resources efficiently and make informed strategic decisions, while common forecasting mistakes can lead to significant financial missteps.

Understanding various forecasting techniques enhances the ability to anticipate market changes and adapt accordingly.

Benefits of Financial Forecasting

Forecasting serves as a critical tool for organizations seeking to navigate the complexities of financial management.

By employing financial trend analysis, businesses can identify patterns and anticipate future performance. This proactive approach enhances decision-making and resource allocation.

Moreover, forecasting accuracy assessments help refine projections, ensuring strategies align with evolving market conditions, ultimately fostering financial stability and empowering organizations to thrive amidst uncertainty.

Techniques for Accurate Predictions

Accurate predictions hinge on the application of various techniques that enhance the reliability of financial forecasting.

Employing forecasting techniques such as predictive analytics and trend analysis allows businesses to analyze economic indicators effectively.

Scenario planning and statistical models facilitate comprehensive risk assessment, while market research and data visualization provide insights into performance metrics.

Together, these methods promote informed decision-making and strategic planning.

Common Forecasting Mistakes

Many businesses overlook critical pitfalls in the forecasting process, which can lead to misguided strategies and financial discrepancies.

Common forecasting errors include data misinterpretation, unrealistic assumptions, and time frame issues. Additionally, analysis inaccuracies arise from model limitations and trend neglect.

These prediction pitfalls often stem from communication gaps, hindering the essential feedback loop necessary for refining forecasts and achieving accurate financial planning.

Building Financial Relationships With Vendors

Establishing strong financial relationships with vendors is crucial for businesses seeking stability and growth.

Effective vendor negotiation strategies foster mutual benefits, ensuring favorable terms.

Maintaining vendor trust is essential; timely payments and transparent communication pave the way for long-term partnerships.

Communicating Effectively With Stakeholders

Effective communication with stakeholders is crucial for successful bookkeeping practices.

Clear reporting practices ensure that all financial information is presented transparently, fostering trust and understanding.

Additionally, implementing active listening techniques can enhance engagement and facilitate constructive feedback, further strengthening stakeholder relationships.

Clear Reporting Practices

While clear reporting practices are essential for successful stakeholder communication, the methods employed can significantly impact the interpretation of financial data.

Transparent communication is crucial, as it fosters trust and understanding among stakeholders. Utilizing consistent metrics ensures that all parties interpret the data uniformly, thereby reducing misunderstandings.

Ultimately, effective reporting practices empower stakeholders to make informed decisions, enhancing overall organizational transparency.

Active Listening Techniques

Active listening techniques play a pivotal role in fostering effective communication with stakeholders.

By employing active listening, individuals enhance their communication skills through engagement strategies and empathy building.

Utilizing questioning methods and feedback techniques facilitates clarity, while summarization skills ensure understanding.

Nonverbal cues and an attentive presence further strengthen relationships, ultimately leading to relationship enhancement and improved stakeholder collaboration within the bookkeeping framework.

Developing a Financial Policy Manual

A financial policy manual serves as a crucial framework for any organization, outlining the principles and procedures that govern financial management.

Effective manual development requires a thorough understanding of the organization's financial goals, regulatory requirements, and operational practices.

Techniques for Reducing Financial Errors

Reducing financial errors is essential for maintaining the integrity of an organization's financial reporting.

Implementing robust error detection systems, enhancing financial training, and utilizing process automation can significantly improve accuracy.

Regular data validation, structured review cycles, and peer audits promote accountability.

Real-time monitoring and feedback loops facilitate timely error analysis, while accuracy checks ensure that discrepancies are swiftly addressed, fostering a culture of precision.

Conducting Regular Financial Audits

Conducting regular financial audits is essential for ensuring the accuracy and integrity of financial records.

These audits not only help identify discrepancies but also reinforce accountability within an organization.

Understanding the importance of financial audits, the steps involved, and common mistakes can significantly enhance the effectiveness of the auditing process.

Importance of Financial Audits

Financial audits serve as a crucial safeguard for organizations, ensuring the integrity and accuracy of their financial statements.

The audit significance lies in identifying discrepancies and fostering transparency, which enhances stakeholder trust.

By conducting regular audits, organizations can uphold financial integrity, mitigate risks, and promote accountability.

Ultimately, this practice empowers them to operate with greater confidence and freedom in their financial decision-making.

Steps for Conducting Audits

While organizations may vary in size and complexity, the fundamental steps for conducting audits remain consistent across the board.

Effective audit preparation involves creating an audit checklist, defining audit methodologies, and assigning audit team roles.

Proper audit documentation ensures accuracy, while comprehensive audit reporting and diligent follow-up address audit findings.

Conducting audit risk assessment and ensuring audit compliance are essential for maintaining organizational integrity.

Common Audit Mistakes

Although audits are essential for ensuring financial accuracy, several common mistakes can undermine their effectiveness.

Ignoring audit preparation tips often leads to overlooked details, while failure to recognize common oversight pitfalls can result in significant discrepancies.

The Role of Technology in Bookkeeping

As businesses increasingly navigate complex financial landscapes, technology has emerged as a crucial ally in the realm of bookkeeping.

Cloud bookkeeping and fintech solutions offer automation benefits, enhancing efficiency through digital invoicing and real-time tracking.

Mobile apps facilitate remote collaboration, while AI integration and machine learning improve data security, ensuring accuracy and reliability.

Embracing these advancements empowers businesses to thrive in a dynamic financial environment.

Networking With Other Financial Professionals

Building a robust network with other financial professionals is essential for bookkeepers seeking to enhance their expertise and career opportunities.

Engaging in networking events, industry conferences, and local meetups fosters peer collaboration and knowledge sharing.

Professional associations and online forums provide mentorship opportunities, while financial workshops strengthen skills.

Establishing referral networks can lead to new clients, promoting growth and freedom in one's career.

Understanding Financial Regulations

Understanding financial regulations is crucial for effective bookkeeping, as they dictate the framework within which businesses operate.

An overview of key regulations, compliance requirements, and the consequences of non-compliance highlights the importance of adhering to these standards.

This knowledge not only safeguards the integrity of financial practices but also mitigates potential legal repercussions.

Key Financial Regulations Overview

Financial regulations serve as the backbone of a stable economic environment, guiding businesses in their financial practices and ensuring compliance with legal standards.

A comprehensive financial regulations overview reveals the complexities and compliance challenges that organizations face.

Navigating these regulations is essential for fostering transparency and accountability, ultimately empowering businesses to operate effectively within the legal framework while promoting economic freedom.

Compliance Requirements Explained

While navigating the complex landscape of compliance requirements, organizations must recognize the pivotal role that adherence to financial regulations plays in their operational integrity.

Regular compliance audits, keeping abreast of regulatory updates, and understanding industry standards are essential.

Additionally, responding to legislative changes and investing in compliance training fortifies risk management strategies, ensuring organizations maintain their commitment to ethical and lawful practices in financial operations.

Consequences of Non-Compliance

Neglecting compliance with financial regulations can lead to severe repercussions for organizations.

Legal penalties and regulatory fines may ensue, resulting in financial losses and tax liabilities. Reputational damage can erode client trust, while operational disruptions hinder business continuity.

Furthermore, inadequate employee training may trigger compliance audits, escalating risks.

Ultimately, the cumulative impact of non-compliance jeopardizes an organization's freedom to operate effectively in the marketplace.

Tips for Training Your Bookkeeping Staff

Training bookkeeping staff effectively is essential for maintaining accurate financial records and ensuring compliance with regulatory standards.

Implementing mentorship programs and online training enhances skill assessment, while role-playing exercises and group workshops promote effective communication.

Regular performance evaluations and feedback sessions encourage continuous improvement, fostering a culture of knowledge sharing.

Additionally, team-building activities strengthen collaboration, ultimately leading to a more competent and cohesive bookkeeping team.

Creating Financial Reports for Decision-Making

Effective training of bookkeeping staff lays the groundwork for producing reliable financial reports, which are vital for informed decision-making.

Employing financial data visualization techniques enhances comprehension, enabling stakeholders to interpret complex data swiftly.

Strategies for Reducing Business Costs

Many organizations are continuously seeking innovative strategies for reducing business costs to enhance profitability and operational efficiency.

Implementing cost reduction techniques such as streamlining processes, leveraging technology, and negotiating supplier contracts can significantly lower expenses.

Moreover, fostering a culture of continuous improvement encourages employees to identify further savings opportunities, ultimately driving financial stability and allowing businesses the freedom to reinvest in growth initiatives.

Tracking Financial Performance Metrics

How can businesses accurately assess their financial health?

By employing financial trend analysis and performance benchmarking, they can achieve key metric identification and variance analysis.

Profitability tracking and KPI development enhance forecasting accuracy, while operational efficiency metrics reveal insights into revenue growth analysis.

These tools collectively contribute to a comprehensive financial health assessment, empowering businesses to make informed decisions and pursue greater freedom in their operations.

Using Dashboards for Financial Monitoring

While traditional financial reports provide essential insights, utilizing dashboards for financial monitoring offers a more dynamic and visual approach to tracking key performance indicators.

By employing dashboard visualization techniques, businesses can easily identify financial data trends, enabling them to make informed decisions swiftly.

This method enhances transparency and allows for real-time analysis, empowering stakeholders to respond proactively to changing financial landscapes.

Establishing a System for Petty Cash

Establishing a system for petty cash requires careful consideration of defining cash limits and implementing effective transaction tracking.

Clearly defined limits help prevent misuse and ensure that funds are available for necessary expenses.

Meanwhile, accurate tracking of transactions is crucial for maintaining financial integrity and facilitating proper reconciliation.

Defining Petty Cash Limits

A well-defined petty cash limit is essential for maintaining financial control within an organization.

Effective petty cash management begins with setting cash limits that reflect operational needs while preventing misuse.

Tracking Transactions Effectively

Implementing an effective tracking system for petty cash is crucial for ensuring transparency and accountability in financial transactions.

Utilizing transaction categorization strategies enhances the clarity of expenses, while effective bookkeeping methods promote accuracy.

Understanding the Importance of Financial Ethics

Why does financial ethics hold such a critical place in the realm of bookkeeping? Upholding financial integrity fosters trust building and compliance culture among stakeholders.

Ethical dilemmas can challenge moral principles, making accountability standards essential. Transparency practices enhance corporate responsibility, while ethical decision making safeguards stakeholder trust.

In essence, financial ethics serves as the foundation for sustainable business practices and sound bookkeeping.

Tips for Handling Financial Disputes

Navigating financial disputes demands a strategic approach to ensure effective resolution.

Employing negotiation tactics and mediation strategies facilitates conflict management. Effective communication and robust documentation practices are essential for clarity and transparency.

Stakeholder engagement enhances relationship management, while careful legal considerations safeguard interests.

In complex cases, financial arbitration may become necessary, reinforcing the importance of a structured dispute resolution process for sustainable outcomes.

Exploring Outsourcing Your Bookkeeping

Outsourcing bookkeeping has become an increasingly popular strategy among businesses seeking to streamline operations and reduce overhead costs.

The outsourcing benefits include significant cost savings and time efficiency, allowing firms to access expert knowledge while enhancing scalability options.

However, effective vendor selection and quality assurance are crucial. Additionally, businesses must address potential communication challenges and implement robust transition strategies for successful risk management.

The Impact of Economic Changes on Bookkeeping

As economic conditions fluctuate, the landscape of bookkeeping is inevitably affected, prompting businesses to adapt their financial management strategies.

Economic fluctuations necessitate bookkeeping adjustments to accommodate inflation impacts and recession effects.

Market volatility requires precise financial forecasting and effective cost management to maintain cash flow.

Regulatory changes further challenge accountants, emphasizing the need for business resilience in navigating these dynamic economic environments.

Strategies for Managing Debt

Effective debt management is crucial for businesses seeking financial stability and growth amidst challenging economic conditions.

Strategies include evaluating debt consolidation options, budgeting for repayment, and understanding interest rates.

Creating a debt repayment plan involves prioritizing high-interest debts and negotiating with creditors.

Leveraging financial counseling and assessing loan terms can lead to viable debt relief programs, ultimately helping businesses avoid future debt and achieve financial freedom.

Understanding Investment Accounting

While many businesses focus on operational aspects, understanding investment accounting is essential for making informed financial decisions.

Effective asset management requires a keen grasp of investment strategies, portfolio diversification, and market analysis. By evaluating investment valuation and financial risk, businesses can optimize returns from equity investments and fixed income.

Staying attuned to economic indicators and investment trends fosters wealth accumulation and aligns with strategic financial planning and investment horizons.

The Role of Bookkeeping in Business Growth

Bookkeeping serves as the backbone of business growth by providing critical financial insights and fostering informed decision-making.

Effective bookkeeping strategies enable businesses to monitor expenses and revenues, paving the way for financial scalability.

Leveraging Financial Data for Marketing Strategies

A wealth of financial data can significantly enhance marketing strategies by providing deeper insights into customer behavior and preferences.

Through effective data analysis, businesses can achieve marketing alignment, optimize campaigns, and allocate budgets efficiently.

Financial forecasting and performance measurement enable precise ROI assessment, while audience segmentation and trend identification foster targeted approaches, ensuring that marketing efforts resonate with the intended audience and drive meaningful results.

Tips for Transitioning to a New Bookkeeping System

Transitioning to a new bookkeeping system requires a careful assessment of the current system's strengths and weaknesses.

Establishing clear objectives is essential to ensure that the new system aligns with the organization's financial goals.

Assess Your Current System

When evaluating an existing bookkeeping system, it is essential to identify its strengths and weaknesses to ensure a smooth transition to a new system.

A thorough current system evaluation can reveal inefficiencies, guiding the development of effective system improvement strategies.

Set Clear Objectives

Establishing clear objectives is crucial for any business looking to implement a new bookkeeping system, as these goals provide a roadmap for the transition.

This involves goal alignment and objective prioritization, complemented by measurable targets and performance metrics.

Strategic planning should include outcome assessment, accountability measures, and resource allocation, while timeline development ensures that success indicators are met efficiently and effectively throughout the process.

Building a Strong Financial Team

How can a business ensure its financial operations are both efficient and effective?

Building a strong financial team hinges on team collaboration and clear role assignments. Continuous skill development and financial training enhance expertise, while performance evaluation and communication strategies foster alignment with goals.

Effective conflict resolution and resource allocation are vital for team motivation, ultimately driving financial success and operational excellence.

The Importance of Continuous Learning in Finance

As the financial landscape continually evolves, the importance of continuous learning in finance cannot be overstated.

Engaging in lifetime learning through finance certifications, online courses, and financial workshops ensures professionals remain adept at navigating industry trends and investment strategies.

Participation in mentorship programs enhances financial literacy, while staying updated on regulatory changes and risk management practices is essential for informed decision-making and long-term success.

Developing a Personal Finance Management System

Establishing a personal finance management system is essential for achieving financial stability and growth.

Key components include setting clear financial goals, employing effective budgeting techniques, and tracking expenses meticulously.

Setting Financial Goals

Clarity in financial goals serves as a cornerstone for effective personal finance management.

By employing goal setting strategies, individuals can articulate a compelling financial vision that aligns with their aspirations. This structured approach not only fosters motivation but also enhances decision-making capabilities.

Ultimately, establishing clear financial objectives empowers individuals to navigate their financial landscape, paving the way for greater freedom and fulfillment.

Budgeting Techniques Overview

Budgeting serves as a vital tool in the development of an effective personal finance management system.

By employing budget allocation strategies, individuals can prioritize spending according to their financial goals.

Additionally, expense reduction techniques enable them to identify unnecessary costs, fostering a sense of control and freedom.

This strategic approach empowers individuals to manage their finances more effectively, paving the way for financial independence.

Tracking Expenses Effectively

Effective tracking of expenses is a cornerstone of any successful personal finance management system. Employing expense categorization techniques allows individuals to discern spending patterns, ultimately fostering informed financial decisions.

Various tracking software options enhance this process, enabling users to monitor their expenses in real-time. By integrating these tools, one can achieve greater financial freedom and maintain control over their financial landscape.

Celebrating Financial Milestones and Achievements

How can organizations effectively recognize their financial milestones and achievements?

Milestone celebrations serve as vital touchpoints for engagement and motivation. By implementing structured achievement recognition programs, companies can foster a culture of appreciation and progress.

These initiatives not only reinforce financial goals but also empower employees, aligning their efforts with organizational success and promoting a sense of ownership in the company's financial journey.

Conclusion

In navigating the intricacies of bookkeeping, one may recall the wisdom of ancient scholars who emphasized the importance of foundational knowledge. Mastering these fundamentals equips individuals not only to maintain compliance but also to seize opportunities for growth. Just as a skilled architect relies on sound blueprints, effective financial management hinges on accurate record-keeping and strategic decision-making. By embracing continuous learning and celebrating milestones, aspiring financiers can construct a resilient framework for long-term success, echoing the enduring principles of fiscal stewardship.